The Race for the Wrist and Finger: The New Era of Continuous Blood Pressure Monitoring and the Tech Giants Battling to Lead It

Download the Full Report written by Yair Lurie, Cardiowell Founder.

Introduction: The Problem We’re Trying to Solve

Hypertension is the world’s most neglected and preventable epidemic.

According to the World Health Organization’s 2024 Global Hypertension Report, over 1.4 billion people worldwide live with high blood pressure, and half don’t even know it! In the United States alone, 122 million Americans have it, more than 75% of whom don’t have it under control, even if they’re taking medication.

Some of the reasons include:

· Patients lack continuous guidance and feedback -Most are just doing the best they can with little support.

· Doctors are overwhelmed and outnumbered due to a global shortage of healthcare professionals, resulting in less time per patient.

· There is little financial incentive because the healthcare system still favors sick care over prevention.

Hypertension is complex and often misunderstood.

“Hypertension is a lifestyle problem managed with a pharmaceutical solution. That’s broken.”

Today, we’re treating a daily, dynamic, largely behavior-driven condition with episodic office visits and static medication plans. That doesn’t scale with the current doctor-patient ratios.

To solve the epidemic, we need real-time, personalized data in the hands of the patient.

That’s how wearable and continuous blood pressure monitoring can help.

Section 1: How We Measure Matters – The Technologies Powering Wearable BP Monitoring

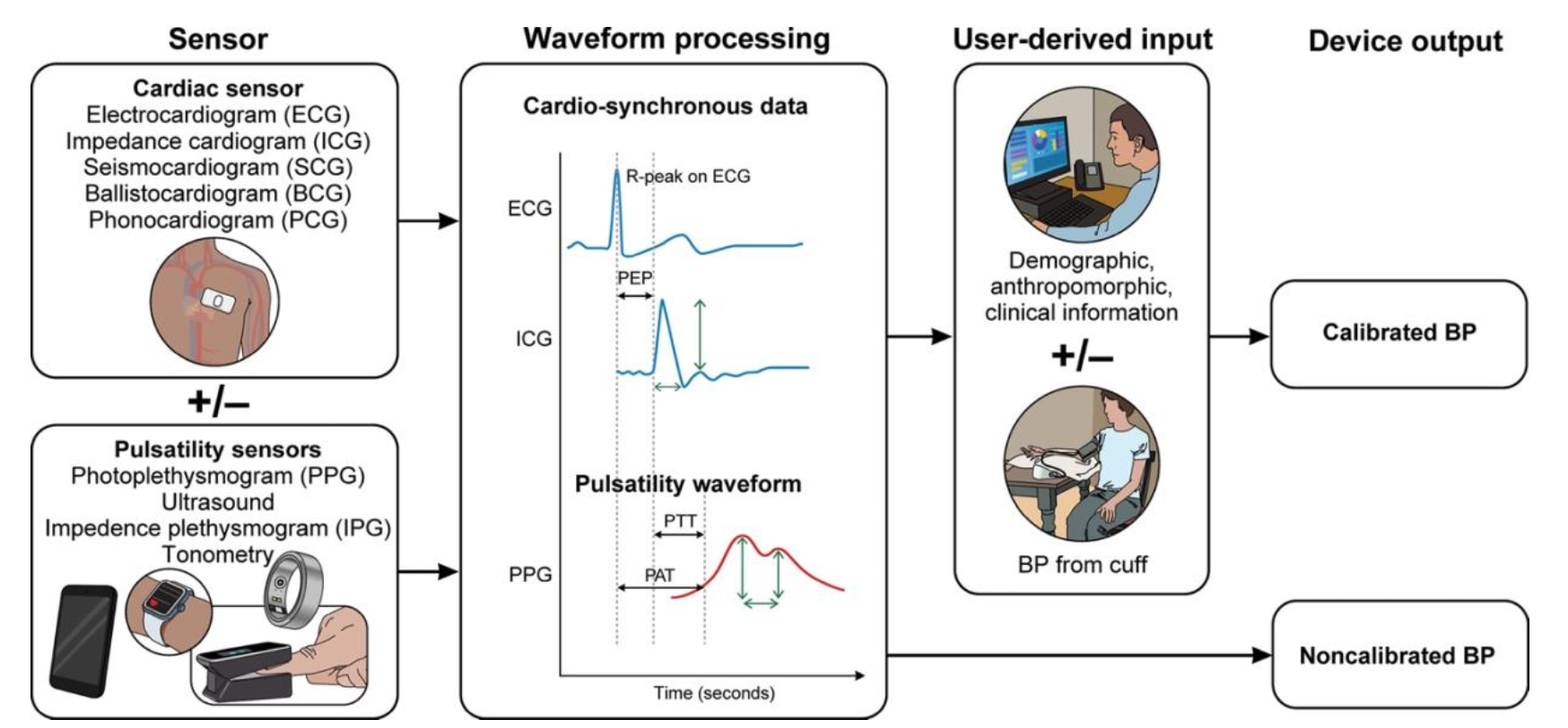

No non-cuff wearable device today measures blood pressure directly. Unlike traditional cuffs that physically compress the artery to detect pressure changes, wearable devices rely on algorithms that estimate blood pressure by interpreting signals from light, sound, electricity, or time-based pulses. These estimates can introduce accuracy challenges, such as drift, calibration issues, skin tone variability, and interference from position and motion.

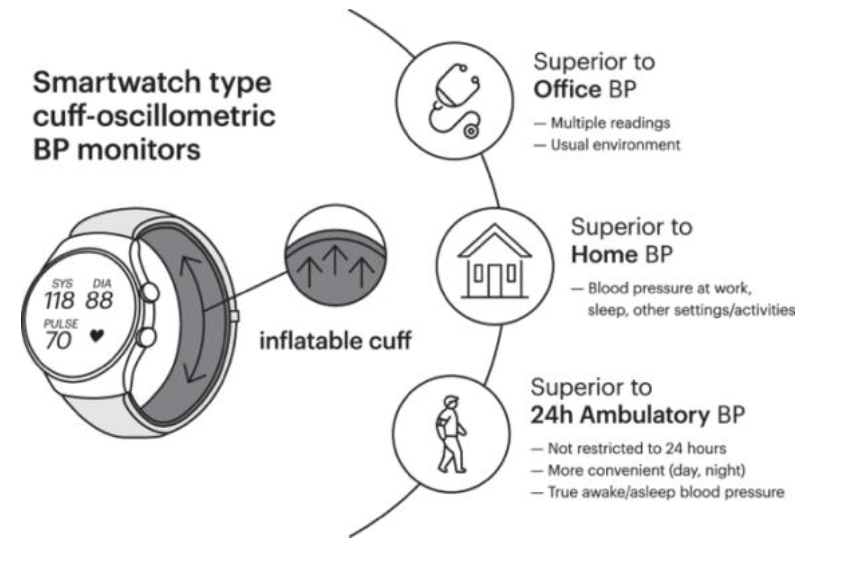

Comparing Cuff-Based and Cuffless BP Monitoring Technologies

Blood pressure is a dynamic indicator of your health that can change minute to minute in response to stress, movement, diet, and sleep. That’s why the technique we use to measure blood pressure matters more than ever. As technology shifts toward wearable, continuous monitoring, it’s essential to understand the trade-offs between cuff-based and cuffless methods and why no wearable device today is a true replacement for the traditional cuff.

Traditional Cuff-Based Blood Pressure Monitoring (Oscillometric)

Advantages

· Clinically accepted and time-tested.

· Validated protocols exist for accuracy and standardization.

· Widely used for diagnosis and treatment decisions (i.e., Welch-Allyn, Phillips).

· Available in both clinic and home-use forms (e.g., Omron, Withings).

Limitations

· Not continuous (i.e., hourly) —captures only “snapshot” readings.

· Requires user intervention—placement, stillness, manual inflation.

· It can be inaccurate in individuals with larger arms or those with arrhythmias requiring the correct cuff size.

· Not ideal for active use or nighttime measurement.

· It can cause discomfort and adherence fatigue with repeated use.

Recent research from Cambridge shows that traditional cuffs, depending on arm position, can either over or underestimate systolic blood pressure by an average of 6 mmHg.

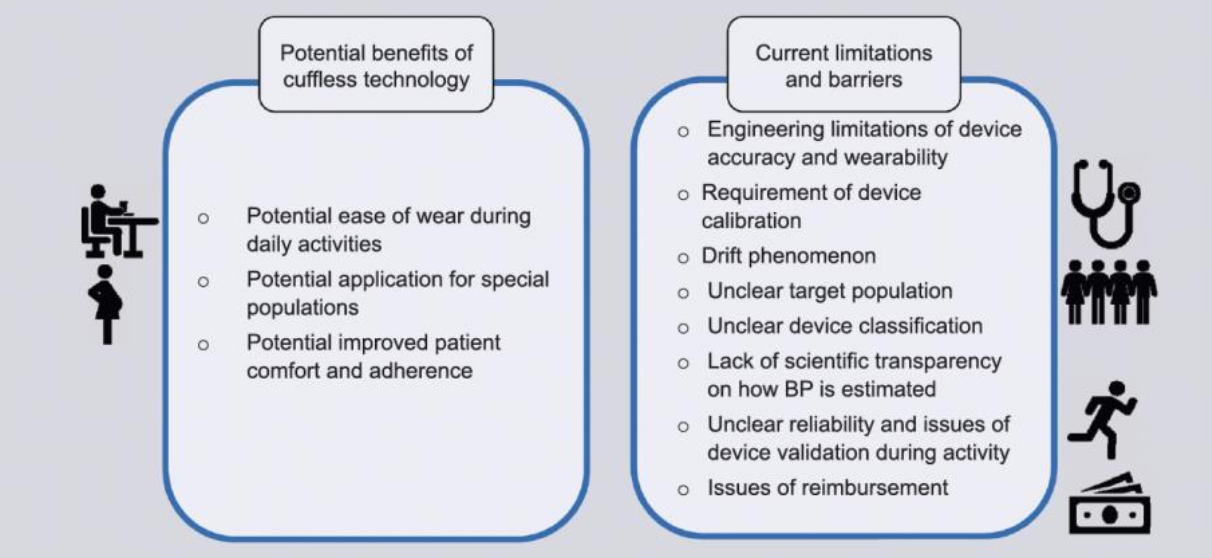

New Cuffless-Based Blood Pressure Monitoring

Cuffless devices like rings, watches, and patches promise passive, real-time blood pressure trends, relying on complex estimation techniques rather than direct pressure measurement. They don’t compress an artery; they infer pressure using physiological signals (light, timing, waveform shape), which introduces unique limitations.

Advantages

· Comfort and ease of wear throughout daily activities.

· Applicable for special populations where cuffs are problematic.

· Potential for greater adherence due to convenience.

· Real-time tracking supports hypertension trend identification.

The limitations are numerous

| Limitation | https://academic.oup.com/ajh/article-pdf/35/5/380/43630856/hpac017.pdf |

|---|---|

| No direct BP measurement | All wearable technologies estimate BP using proxies like time delay (PTT/PAT), light absorption (PPG), or waveforms (PWA). None apply direct pressure like a cuff. |

| Requires frequent calibration | Most devices must be calibrated to a cuff-based oscillometric monitor, often every few days to months (e.g., Biobeat every 3 months, Hilo once a month). The calibration is only as effective as the technique used (e.g., arm position, stress level, etc.) when using the cuff device. |

| Sensor drift | Devices gradually deviate from the calibration baseline over time—a phenomenon known as “drift.” Accuracy erodes unless recalibrated. |

| Motion sensitivity | Physical activity and changes in body position introduce motion artifacts, degrading signal quality and leading to inaccurate readings. |

| Lack of diversity validation | PPG sensors have not been validated across all skin tones, which affects signal interpretation. Most studies underrepresent darker skin tones. |

| Physiological variability | Estimation methods assume individual constants, such as blood density and arterial size, which vary across people, making universal models unreliable. |

| Limited data in special populations | Accuracy has not been well studied in pregnant women, people with arrhythmias, large arms, or heart failure. |

| Not validated during activity | Calibration is usually done at rest, yet devices are marketed for use during daily life—a mismatch that affects accuracy. |

| Lack of scientific transparency | Many companies rely on proprietary algorithms with little peer-reviewed data on how blood pressure is actually estimated. |

| Reimbursement and regulatory gaps | Most devices are not eligible for insurance reimbursement, and FDA clearance does not guarantee accuracy (see Section 2). |

The “Paradox” of Cuffless BP

“Some researchers describe a paradox in cuffless BP: in simulation, estimates can look more accurate when driven by calibration BP, population averages, and demographics like age and sex than when driven by the wearable’s physiological signal alone—raising the concern that some systems may lean heavily on priors rather than true measurement.”

The Bottom Line

Cuffless BP wearables are in a continuous state of evolution. They offer a vision of real-time, passive, personalized cardiovascular data. For now, they should be seen as complementary tools rather than replacements for cuff-based monitors, especially for clinical decisions. Until standards, validation, and accuracy improve across diverse populations and real-world conditions, caution is warranted.

Here’s a breakdown of the core technologies used in cuffless devices:

| Technology | What It Measures | Key Advantages | Key Limitations | Companies / Devices Using It |

|---|---|---|---|---|

| Pulse Transit Time (PTT) aka PWTT |

Time for pulse wave to travel between two points (ECG → peripheral sensor) |

|

|

|

| Pulse Arrival Time (PAT) | Similar to PTT between two points (ECG → pulse arrival time), includes pre-ejection period (PEP) |

|

|

|

| Photoplethysmography (PPG) | Optical detection of blood volume changes |

|

|

|

| Pulse Wave Analysis (PWA) | Analysis of shape & morphology of pulse waveform (from PPG) |

|

|

|

| Tonometry | Arterial pressure via surface sensor (radial artery) |

|

|

|

| Oscillometric (Cuff-Based) | Arterial oscillations during cuff inflation/deflation |

|

|

|

The Calibration & Drift Dilemma

All non-cuff methods are estimations, not direct measurements. Most will require baseline calibration with a standard cuff. Over time, however, the accuracy drifts due to changes in vascular tone, hydration, stress, and even sleep quality. Without recalibration, these devices risk under- or overestimating blood pressure, which is critical when making medication or lifestyle decisions.

A solution to the drift issue is regular calibration between the wearable and a traditional cuff. The cuff-based device augments and improves the accuracy of the cuffless device. An innovation to improve accuracy is the use of an always-connected cuff-based device connected to the ‘cloud’ via an integrated cellular connection. This allows the cuffless device to be continuously calibrated whenever the cuff-based device is used, thereby increasing accuracy.

With the cuffless technology now better understood, it’s time to understand the regulatory requirements.

Section 2: What FDA Clearance Really Means

When Apple announced that it had received FDA clearance for its blood pressure notification system, many headlines mistakenly called it a “breakthrough approval.” But FDA clearance is not the same as FDA approval, and it does not mean a device is accurate in measuring blood pressure. This misunderstanding is one of the most critical gaps in public knowledge around wearable health tech.

FDA-Approved vs. FDA-Cleared – A Critical Distinction

· FDA Approval is granted for Class III medical devices, which are high-risk devices (such as pacemakers). Approval means the device has been proven safe and effective through rigorous clinical trials.

· FDA Clearance applies to Class II devices (like blood pressure monitors). Manufacturers go through the 510(k) pathway, which simply requires them to show that their device is “substantially equivalent” to another device that’s already on the market.

Clearance means: “This new product is similar to an existing one that we’ve already cleared.”

It does not mean the device has proven its accuracy, especially for new use cases such as cuffless wearable BP monitoring.

What is the 510(k) Pathway?

The 510(k) premarket notification process is how most wearable BP devices get on the market. Here’s how it works:

1. A manufacturer submits documentation showing that its new device is similar in design, function, and intended use to an already-cleared device (a “predicate”).

2. The FDA evaluates whether this new device is “substantially equivalent” in safety and effectiveness.

3. If so, the device is cleared—not approved—for marketing.

The predicate does not even have to use the same underlying technology. It only has to support the argument that the new device is “substantially equivalent” in intended use and overall safety/effectiveness.

There’s no requirement for new clinical trials or real-world performance testing unless the product is radically different. For wearable BP devices, this is a major loophole.

No Requirement for Proven Accuracy

FDA clearance does not require the device to demonstrate clinically validated accuracy using standardized blood pressure protocols.

This means:

· A cuffless device using optical sensors (PPG) or pulse timing (PTT/PAT) may be cleared without robust independent studies.

· Proprietary algorithms used to estimate BP are often not disclosed or peer reviewed.

· Devices calibrated against oscillometric, whether the cuff is worn on the arm or wrist, inherit their margin of error—they’re building an estimate on top of an estimate.

As one recent paper summarized:

Manufacturers are only required to demonstrate that their device is as safe and effective as similar devices on the market, a concept known as “substantial equivalence.” There is no specific requirement that the device has demonstrated accuracy using a specific validation protocol.

I experienced this firsthand at the CMEF conference in China last year. I tested an FDA-cleared oscillometric pressure-based device with the cuff built into the watch band. My informal testing showed a difference of about 8-10 mmHg systolic compared to my trusted home automatic upper arm device. For wrist-based cuff-type devices, proper fitting and arm position are especially important. The technology has come a long way and still has room for improvement, perhaps by combining PPG, PWA, PTT, and other types of measures.

Real-World Implications: Trust, Risk, and Responsibility

For consumers, this creates a dangerous assumption: “If it’s FDA-cleared and Medical Grade (MG), it must be clinically accurate.”

This assumption is especially risky when consumers or even clinicians make treatment decisions based on these devices. Consider:

· Someone reduces or skips medication based on a falsely low BP reading.

· A clinician overlooks hypertensive patterns because the data was off due to sensor drift.

· A wearable flags someone as hypertensive based on a flawed estimate—causing anxiety and unnecessary follow-up.

As wearable BP data becomes increasingly integrated into telehealth, insurance, and remote patient monitoring (RPM), these errors are increasingly consequential.

On January 6, the FDA released updated guidance, softening its stance on wearables and AI-based decision-making technology. The updated guidance generally limits regulation on low-risk, general wellness wearables (like fitness trackers) that don’t claim to diagnose or treat diseases, even for parameters like estimated blood pressure, as long as they focus on lifestyle and don’t guide clinical action.

This shifts focus from stringent oversight to encouraging innovation. Still, devices making specific medical claims (e.g., for hypertension, diabetes) or intended as replacements for cleared medical devices remain regulated medical devices requiring FDA clearance, creating a clearer distinction between wellness tools and medical tools for consumers and developers. Less FDA review means that clinical validation, post-market monitoring, and transparency will be shifted even more onto manufacturers.

Product positioning and intended use language will matter more than the technology itself. Right now, the difference between needing and not needing FDA approval for a device comes down to intended use and claims. And this can all come down to marketing. If a device is marketed with claims to diagnose, treat, mitigate, cure, measure, or prevent a specific disease or condition, it faces FDA scrutiny. Does it claim to measure blood pressure, or does it provide an indication, notification, or estimation of blood pressure health?

What Else Needs to Change

To ensure wearable BP devices truly benefit patients, several key improvements are needed:

1. A universal validation protocol for cuffless BP devices—like what exists for traditional monitors (e.g., AAMI/ESH/ISO standards).

2. Independent accuracy testing in diverse populations and real-world settings.

3. Transparent reporting of the algorithmic methods used for estimation.

4. Post-market surveillance to track device performance over time.

Until these changes are standard, FDA clearance alone should not be considered a guarantee of trustworthiness.

My Bottom Line

While FDA clearance allows companies like Apple, Omron, Aktiia, and others to bring exciting new technologies to market, it is not a stamp of clinical accuracy. It simply means the device is like what’s already out there—not that it’s been rigorously proven to work in all settings or for all people. More than the technology and the accuracy, what is important are the claims and intended use.

As consumers and healthcare providers, we must look beyond the clearance badge and ask:

Has this device been independently validated? Has it been tested in real-world use cases? And is it safe to rely on it for serious decisions?

Until then, we must continue to use our tried-and-true, trusted upper-arm blood pressure monitor.

Section 3: Apple’s Strategic Dominance – Clinical Rigor and Market Power & Aktiia’s Go-to-Market Edge

In the race to bring continuous blood pressure insight to everyday wrists (and beyond), Apple and Akttia stand out for achieving real regulatory recognition that others are still chasing.

Apple Watch’s FDA Clearance for Blood Pressure Notifications: What Was Cleared and Why It Matters

In September 2025, Apple received FDA clearance for its Hypertension Notification Feature, a machine-learning-based algorithm that runs on compatible Apple Watch models (Series 9, Series 10, Series 11, Ultra 2, and Ultra 3). The feature doesn’t display numerical systolic/diastolic blood pressure values like a cuff. It passively analyzes optical sensor data — including how blood vessels respond to heartbeats over 30 days to alert the wearer to patterns suggestive of hypertension. Reuters+1

This is significant for three reasons:

It’s the first FDA-cleared hypertension-related feature in a major smartwatch platform outside traditional BP cuffs.

The clearance was based on a large study involving more than 100,000 participants, demonstrating sufficiently high specificity such that alerts are meaningful for users who then confirm with clinical measurements. FDA Access Data

It reflects a shift in regulatory thinking from requiring direct BP measurement to allowing pattern-based notifications for public health screening.

However, clearance does not equal proven clinical accuracy. The Watch’s algorithm detects patterns consistent with hypertension rather than directly measuring blood pressure, and it correctly identifies roughly 40% of true hypertensive cases while minimizing false positives. Healthbeat

Apple’s Clinical Rigor: Data, Scale, and Validation

Apple made a bet on data scale, statistical validation, and early cooperation and transparency with the FDA. The company used aggregated optical sensor data from hundreds of thousands of users. Then it sponsored a controlled clinical trial with a reference standard (a traditional cuff monitor) to assess performance. Tom’s Guide

Although the algorithm isn’t perfect (and Apple itself acknowledges it misses some hypertension cases), the study satisfied the FDA that the technology is safe and effective for screening purposes and, importantly, that it benefits public health by flagging undiagnosed hypertension for further evaluation.

Apple’s Ecosystem Advantage: Health Integration and Partnerships

Apple’s strength is the ecosystem:

This ecosystem approach creates stickiness for health-aware users and positions Apple’s platform as both a wellness tool and a research engine.

Apple is only getting started. Next year, they will release their first AI-driven health coach to try to replace the services a real physician provides. I look forward to covering that milestone soon. Similarly, OpenAI has launched ChatGPT Health, allowing users the ability to have their data in Apple Health, their personal medical records, and other healthcare-related Apps examined.

Apple: Pattern Detection at Scale — With Big Clinical and Economic Implications

Apple’s strategy isn’t to measure blood pressure directly like a cuff, but to detect patterns that suggest elevated BP (hypertension) using optical sensors (PPG) and proprietary machine learning models, and notify users they may be at risk. That means:

· The Health app consolidates data from multiple sensors (ECG, heart rate, activity, sleep).

· Research partnerships with institutions and large-scale datasets improve algorithm training.

· Apple collects optical pulse wave data using green and infrared LEDs, accelerometry, and other sensors over long time windows to trigger notifications after a month of ‘calibrations’.

· They trained their model on a large dataset comprising 100,000+ participants to correlate subtle biomarker patterns with confirmed blood pressure readings from reference devices.

The algorithm is not publicly disclosed, and its exact mathematical relationship to physiologic BP is proprietary. Its technology does not require cuff calibration, unlike many others.

Why it matters:

· The solution and strategy work similarly to FDA-cleared high heart rate, sleep apnea, and atrial fibrillation notifications, which, by themselves, can help millions of additional users every year.

· Apple forecasts that this feature could generate ≈1 million notifications per year for users whose wearables detect patterns suggestive of hypertension.

· Those notifications are expected to influence behavioral follow-up, clinical confirmation, diagnosis, and treatment, resulting in more clinician visits, more prescriptions, and more downstream care revenue across the health ecosystem, including the sale of more cuff-based blood pressure devices.

· For Apple, the value is in being an upstream signal generator that drives health engagement and clinical action at scale.

This regulatory and engagement model — clearance plus measurable real-world use — gives Apple a different kind of leverage compared with devices that simply list cuffless features.

Aktiia / Hilo: The First FDA-Cleared Cuffless BP Monitoring System

Months before Apple’s hypertension notification cleared in 2025, the Hilo Band (formerly the Aktiia Bracelet) earned FDA 510(k) clearance for continuous cuffless blood pressure monitoring — making it the first cuffless device cleared for this purpose in the US.

Hilo goes beyond simply notifying the user of possible hypertension; it displays the numbers to back it up.

While Apple’s win is a notification layer, Hilo is about ongoing cuffless BP monitoring, and it reached major regulatory milestones earlier and more directly.

· CE-marked in Europe for over a year.

· FDA-cleared for cuffless BP monitoring via the 510(k) pathway. The predicate device appears to be the BioBeat BB-613.

· Built around a specific technique and proprietary algorithms: Pulse Wave Analysis (PWA) on wrist PPG signals, calibrated to a cuff with pattern analysis.

Aktiia’s technology approach is also strategically different from Apple’s:

· Hilo is waveform-first (PWA: shape and features of the pulse waveform).

· It’s more explicitly built as a blood-pressure tracking system, not just a risk alert.

· It accepts the current reality of cuffless BP: calibration is still required, and drift management is part of the deal.

Aktiia isn’t trying to “out-Apple Apple.” It’s playing the medical-adjacent game more directly: measurable readings, repeated monitoring, clinical posture, and European deployment. The device is expected to be available for purchase in the USA in early 2026.

The Hilo Band is not a smartwatch; along with the App, it’s designed to measure only blood pressure. It is a bracelet form factor that uses Bluetooth to display results in the App after the data is analyzed in their cloud. Measurements will not be made unless, at the very least, the patient's arm is free of movement artifact and at a proper position relative to the heart.

Also important: Aktiia has raised 42M in 2025, which signals institutional belief that cuffless BP monitoring is real. Aktiia has mentioned that it was open to licensing its technology. Apple would be a prime customer.

Here’s how it works:

Technology: Pulse Wave Analysis (PWA)

The Hilo Band does not use Pulse Transit Time (PTT). Instead, it uses Pulse Wave Analysis (PWA) algorithms, which analyze the shape and features of the optical pulse waveform to estimate blood pressure using PPG optical sensors. It ships with an inflatable blood pressure cuff for monthly calibration, allowing the Hilo Band to collect ≈25 readings per day under optimal conditions (i.e., arm position and movement).

Hilo’s technology has CE marking in Europe as a Class IIa medical device. It is supported by 18+ years of research and clinical validation factors that likely helped it clear the FDA pathway early. Its continuous, waveform-driven model can offer consistent trend data with less reliance on multi-sensor timing than PTT methods.

Their algorithms are hosted on servers for off-device processing. They can make their servers available to third-party devices in the future, which could open the door to new approvals. Hilo has mentioned that they are open to licensing their technology, making Apple a prime customer.

Samsung: Falling Behind in Regulatory and Product Momentum

Samsung has long hinted at cuffless blood pressure features for its Galaxy Watch lineup, and has developed promising algorithms that combine optical (PPG) data with motion and other sensors. But as of late 2025, Samsung has not yet received FDA clearance for a BP or hypertension detection feature in the US, and regulatory approval remains a major hurdle. Division of Cardiology. Read my article titled “The Promises and Challenges of Continuous Blood Pressure Monitoring: Comparing Apple and Samsung” for some background information.

Without clearance, Samsung’s cuffless BP offerings remain limited to markets outside the US or to non-medical wellness use cases, and the brand struggles to match Apple’s perceived legitimacy, which it has gained through regulatory endorsement.

Where Google Fits In: Research at Scale Without Clearance (Yet)

While Apple has regulatory clearance, Google (via Fitbit and Pixel Watch platforms) has taken a different tack.

In late 2025, Google launched a large-scale health study via FitBit Labs, which is recruiting up to 10,000 US Pixel Watch 3 owners to collect cardiovascular data, including blood pressure readings paired with wearable data over 180 days. Participants may use a traditional BP cuff alongside their Watch to help build a dataset that could improve future predictive models. Android Central. You can register via the Fitbit app to participate in the study.

This initiative is not FDA clearance — it’s research aimed at building the data foundation for better algorithm development. Google’s strategy appears to be:

Leverage massive passive data collection.

Use machine learning to build predictive models for early detection of hypertension.

Potentially pursue regulatory approval later, armed with real-world evidence.

This approach mirrors parts of Apple’s data-driven validation and has not yet resulted in regulatory clearance, making Google a major player in research and data development but behind Apple in market-ready clinical features.

Other Players Worth Watching

While Apple, Samsung, and Google dominate mainstream mindshare, other companies are quietly advancing the state of the art:

· Withings is integrating cardiovascular biomarkers into its connected health ecosystem and participating in clinical research partnerships that could support future BP estimation features. They have an exciting lineup and are a significant digital health innovator. I am particularly excited about their new Body Scan 2 device, just launched at CES, which can track 60 longitudinal biomarkers, enable early detection of health issues, and predict longevity.

· Academic and open data initiatives, such as the multimodal dataset from research groups exploring the synergy between wearable ECG and PPG data (e.g., the HEART Watch research involving Pixel hardware), are building valuable validation and development resources that industry players could leverage. arXiv

· Clinical-grade medical device companies (not consumer brands) are also developing validated continuous monitors, but face slower commercialization due to regulatory rigor.

· Ring-based devices are coming – See Section 4 for details.

Whoop: Innovation Caught in the Wellness Paradox

Whoop’s position has been notably different:

· Whoop introduced Blood Pressure Insights as part of its subscription feature set, using a combination of optical pulse wave data, heart rate variability, and machine‑learning algorithms.

· The company did not obtain FDA clearance before rolling out this feature, asserting that it falls under “wellness” rather than “medical” device claims. (Though it did for its arrhythmia detecting feature)

In response, the FDA issued a warning letter, making clear that a feature marketed as blood pressure measurement/estimation crosses the line into medical device territory and requires proper authorization.

Adding to the complexity, Whoop now faces a consumer class-action lawsuit alleging that members were sold a medical capability that wasn’t cleared or validated — another manifestation of what industry analysts call the “wellness paradox.”

As biometric signals become richer and more predictive, companies want to offer health insights — but regulators treat any inference related to disease risk, detection, or monitoring as medical. Companies must walk across a tightrope to ensure their claims are balanced. Even if a company frames the feature as wellness, the moment it implies clinical utility (e.g., “blood pressure estimation”), regulators push back. The question remains why heart rate and pulse oximetry (Sp02) can slide as wellness metrics, though their measurements are clearly clinical in nature and used to detect disease states. (i.e., hypoxia). Blood pressure metrics are now finding themselves in this chasm. One that other clinical signals were able to cross.

The Whoop case shows the risks of innovating too fast without early regulatory engagement: legal exposure on two fronts (FDA enforcement risk and consumer liability), plus reputational risk if users lose confidence in the platform.

Summary: Why Apple Is Ahead (For Now)

Apple’s strategy for blood pressure monitoring stands out because:

· It secured FDA clearance for a clinically meaningful health alert feature at scale.

· It backed that clearance with large-scale validation and real-world population data.

· It has a vast user base. It is only a matter of time before they perfect their algorithms and start providing accurate estimates.

· It integrated the feature into a broader health ecosystem, increasing both utility and user adoption.

· Competitors like Samsung lag in regulatory validation, and Google is betting on research rather than immediate clearance.

In this evolving landscape, regulatory wins translate directly into consumer trust and clinical relevance, and right now, Apple holds that edge.

Section 4: The Ring Revolution - How Oura Is Disrupting the Space

The ring form factor is rapidly emerging as a powerful anchor for continuous health monitoring, especially for cardiovascular metrics that are hard to track accurately at the wrist. And at the center of this shift is Oura, a Finnish company that has gone from a niche sleep tracker to a heavyweight competitor backed by massive funding, a deep patent portfolio, and an aggressive IP strategy.

1. Oura’s Funding Traction — A New Tier of Investment

Oura’s business momentum has been remarkable. Alongside earlier funding rounds, the company recently raised about $900 million in a Series E, pushing its valuation to over $11 billion, a clear signal to investors that smart rings are more than fitness accessories and are positioning themselves as serious health‑tech platforms.

This capital will allow Oura to invest in partnerships, biomarker research, and clinical validation, all critical as wearable monitoring moves into clinical and RPM use cases.

I personally have been a fan of Oura since receiving their Gen1 device in 2015 at one of their San Francisco launch parties.

2. Oura’s Patent Strategy — Lawsuits and Licensing

Patent Litigation Targets

Oura has taken an assertive stance on patents, suing multiple competitors for using their core technologies. The most recent actions include:

· Samsung — Oura filed a federal lawsuit alleging that aspects of the Galaxy Ring infringe on its smart‑ring patents. Oura Ring+1

· Reebok (Smart Ring) — Oura claims its design, internal components, and sensing suite copy key Oura innovations. The Fashion Law

· Zepp Health (Amazfit Helio Ring) — Accused of infringing structural and component design patents. The 5K Runner

· Noise (Luna Ring / Nexxbase) — Another target of Oura’s November 2025 patent suits aimed at blocking import and sales. The 5K Runner

· Ultrahuman– An October 21 ruling effectively aimed to ban the import and sale of Ultrahuman.

· RingConn had a case running for about a year before it was settled.

These suits span multiple patents that cover critical aspects of the wearable ring’s internal architecture and sensor integrations, and in some cases, Oura is seeking ITC (International Trade Commission) exclusion orders that could block imports of infringing devices. The 5K Runner

Samsung, for its part, has pushed back with its own patent claims, asserting that Oura’s patents are overly broad and cover standard features found in many wearable designs. IPFray

Oura’s patent portfolio covers how sensors integrate optical signals, how rings determine cardiovascular health metrics from waveform morphology, and how to measure skin tone to adjust signal interpretation. This feature could help reduce bias in PPG-based estimates. Justia Patents

Licensing Partnerships and Resolved Disputes

Oura isn’t just litigating — it’s also licensing its IP to select partners:

· Circular — Reached a royalty-based license allowing Circular to sell its smart rings in the US while respecting Oura’s patents. TechCrunch

· RingConn and OMATE — Also signed licensing agreements after dispute resolutions, demonstrating that Oura can monetize its IP as well as enforce it. Athletech News

Will Apple create an iRing? Will Google make a Pixel smart ring? Will they need a license from Oura?

Not all litigation outcomes are public victories; for example, an earlier case against RingConn was dismissed with prejudice — likely after confidential settlement — highlighting how legal strategy can shift between public enforcement and negotiated resolution. Patsnap

I personally felt the repercussions of Oura’s patent strategy. I collaborate with a company that temporarily paused its R&D and Go-to-USA-Market strategy after becoming aware of Oura’s latest patent claims.

3. Increasing Biomarkers in Ring Form Factor

One of the most exciting aspects of smart rings is that they now measure far more than sleep. Oura’s devices, like most other rings, collect a suite of biomarkers that go well beyond basic step counts or heart rate, including:

· Photoplethysmography (PPG)‑based cardiovascular signals — the foundation for pulse detection and BP trend estimation.

· Heart rate and Heart Rate Variability (HRV) — crucial for stress, recovery, and autonomic nervous system insight.

· Skin temperature — helpful in detecting circadian changes, illness, and metabolic shifts.

· Respiratory rate — increasingly a signal associated with stress, sleep quality, and cardiopulmonary health.

· Activity & motion patterns — for context around physiological marker changes.

Rings are also uniquely able to capture overnight signals (when wrist wearables can slip or be removed), giving richer datasets for algorithmic models. The more biomarker rings collect, the better their models can contextualize and estimate complex metrics, such as blood pressure trends, even when the signal isn’t a direct pressure measurement. Justia Patents

4. Competitor and Partner Landscape — From Omron to Skylabs

One interesting strategic partnership comes from the traditional BP device maker Omron, which is working with Skylabs, the manufacturer behind CART BP. While Oura competes with ring-based health-tracking offerings, Skylabs positions its ring specifically for cardiovascular measurement, including pulse timing and other correlated signals. Omron’s involvement gives the CART BP ring clinical and commercial legitimacy that may contrast with Oura’s broader health focus.

Oura’s advantage is general health tracking and ecosystem data, while Omron/Skylabs are focused more narrowly on BP and cardiovascular health metrics, often in collaboration with existing clinical workflows.

Valencell was an influential early player in cuffless BP R&D and was planning FDA clearance by 2024, but public signals suggest its posture has changed; its website is currently unavailable, and significant portions of its patent portfolio have been transferred. They also pioneered HRV in the last decade.

The New Era of Biomarkers: Rings, Bands, and Beyond

The miniaturization of sensors has opened the floodgates for detecting a range of biomarkers beyond blood pressure. Leading wearables are now capturing:

| Biomarker | Detected By | Devices Using It | Clinical Relevance |

|---|---|---|---|

| Heart Rate Variability | PPG | Oura, Whoop, Apple, Hilo | Stress, recovery, autonomic function |

| Respiratory Rate | Motion + PPG | Oura, Apple, Whoop | Sleep apnea, early illness detection |

| Blood Oxygen (SpO₂) | PPG (Red/IR LEDs) | Apple, Fitbit, Garmin, Withings | Sleep disorders, respiratory issues |

| Temperature | Infrared, skin sensors | Oura, Whoop, Fitbit | Illness onset, menstrual tracking |

| ECG | Electrodes | Apple, Samsung, CART BP | Atrial fibrillation, arrhythmias |

| Pulse Transit Time (PTT) | ECG + PPG | CART BP, research wearables | Estimated BP (indirect) |

| Pulse Wave Analysis (PWA) | PPG Waveform Morphology | Hilo Band | Estimated BP (direct) |

5. What All This Means for Market Share and Innovation

Oura’s strategy blends three powerful elements:

1. Deep capital reserves of nearly $900M in funding this year fuel aggressive growth, R&D, and legal strategy. Wikipedia

2. Broad and enforceable patents that cover sensor integration, device architecture, and data interpretation. Justia Patents

3. Licensing and litigation balance by enforcing IP where necessary, while licensing to selected players builds an ecosystem.

This positions Oura as an IP platform leader in the smart ring segment—a very different dynamic from most wearable markets, where hardware alone dominates.

But the war isn’t over. Samsung, Reebok, Zepp Health, Noise, and even ring competitor Ultrahuman are all trying to challenge or adapt, each with different strategies and legal responses. As the stakes rise in the US market, ring tech may see exclusion orders, licensing revenues, and shifting alliances that determine who gets to sell hardware and who negotiates the royalties on core technology.

Oura: Data First, IP Protection While Waiting for the Right Regulatory Moment

Oura’s approach is more ecosystem and multi-biomarker-focused:

· Oura is in active collaboration with the FDA on a blood pressure feature and has received approval to study it in its user population in 2026.

· The Oura ring captures PPG signals, motion, temperature, respiratory rate, and HRV, creating one of the richest continuous data sets in wearables.

· Rather than rushing to market with a BP estimation feature, Oura seems content to build the data foundation, patent its core sensing technologies, and carefully choose regulatory paths.

This strategy means slower consumer rollout of blood pressure estimation, but also lower regulatory and legal exposure compared with companies that announce clinical-like features without clearance.

Comparing Methods: Apple vs Whoop vs Oura vs Hilo vs CART BP

| Company / Device | Technique | Sensors | Calibration | Regulatory Status | Notes |

|---|---|---|---|---|---|

| Apple Watch | Pattern recognition via ML (PPG multi-sensor data) | PPG + accelerometer + others | Not traditional cuff calibration | FDA cleared for hypertension notification | No numeric BP; notifications only |

| Whoop MG | Proprietary ML based on PPG/HRV trends | PPG + motion | Varies | No FDA clearance (warning letter) | Faces wellness vs medical scrutiny |

| Oura Ring | Rich PPG multi-biomarker ecosystem | PPG + motion + temperature | Not yet a public clinical BP model | No BP clearance yet | Strong IP and ecosystem data |

| Aktiia / Hilo Band | Pulse Wave Analysis (PWA) | PPG (optical) | Requires regular cuff calibration | FDA cleared (continuous cuffless BP) | First cleared continuous cuffless BP |

| Sky Labs / CART BP Ring | Pulse Transit Time (PTT) | ECG (single lead) + PPG | Initial cuff → ongoing PTT | Under development / CE / clinical | ECG anchors timing to improve accuracy |

Technique Distinctions Explained

· PPG-based Pattern Recognition (Apple & Whoop): These methods infer blood pressure from patterns in optical and other sensor data using machine learning. Apple’s model is built on large datasets, while Whoop’s is proprietary but neither independently validated nor cleared.

· Pulse Wave Analysis (Hilo): The waveform’s shape, slope, and other PPG characteristics are analyzed to estimate BP — a shift from timing-focused methods to morphology-focused models. PWA is closer in spirit to how traditional oscillometric cuffs interpret waveform slopes and amplitudes.

· Pulse Transit Time (CART BP): Calculates the time between electrical cardiac activation (ECG) and peripheral pulse arrival (PPG), then correlates it with blood pressure. PTT requires multi-sensor fusion (ECG + PPG) and calibration, and is promising but still under regulatory development for widespread consumer use.

The Other Devices:

Ring-Based Devices

| Company | Device Name | BP Technique | FDA Status | Notes |

|---|---|---|---|---|

| Circular | Circular Ring | PPG | No clearance | Focuses on sleep, recovery, and exploring BP estimation |

| Movano | Evie Ring | PPG (multi-sensor) | FDA in review | Targeted at women’s health, expanding to BP |

| Ultrahuman | Ultrahuman Ring | PPG | No clearance | Focused on metabolic biomarkers; BP not yet core |

| RingConn | Gen 2 Air | PPG | Wellness only | Working on blood pressure insights to estimate trends |

Special Mentions: Keep an eye on newcomers like Luna and Bond. The latter has made some lofty claims about its sensor capabilities (ECG, continuous BP).

Wrist-Based Devices Under Development

| Company | Device Name | BP Technique | FDA Status | Notes |

|---|---|---|---|---|

| Samsung | Galaxy Watch Series | PPG / PAT | Cleared (Korea only) | Requires monthly calibration; no FDA clearance yet |

| Omron | HeartGuide | Oscillometric (cuff) | FDA-cleared | First genuine FDA-cleared wearable cuff; bulky design |

| Biobeat | Chest/Wrist Sensors | PTT (dual sensors) | FDA-cleared | Used in hospitals; multi-parametric vitals tracking |

Special Mentions: Keep an eye on newcomers like Amazfit, and long-time contenders like Huawei, Garmin, and Fitbit.

Form Factor Pros and Cons

| Feature | Wrist-Based Devices | Ring-Based Devices |

|---|---|---|

| Signal Stability | Moderate; affected by wrist motion | High, stable PPG from the finger |

| Comfort | Familiar but less worn at night | Lightweight and sleep-friendly |

| BP Accuracy | Varies; depends on movement + calibration | Promising; needs more validation |

| Multi-Sensor Capacity | High; larger space for sensors | Growing; newer rings include more sensors |

| Use Case Fit | Suitable for fitness and alerts | Better for sleep, recovery, 24/7 trends |

| Battery Life | 1–2 days (smartwatches) – 8 days (bands) | 4–7 days (rings) |

In summary, wrist devices are currently more validated, but rings are rapidly gaining ground, offering unique advantages in signal fidelity and comfort. Apple, Aktiia, and Omron lead in wrist-based FDA clearances. On the ring side, CART BP may be the most ahead in clinical validation, while Oura dominates in ecosystem and data depth, and will be catching up with FDA recognition in the following year.

Up next: What the future holds and how these trends might reshape the hypertension care model.

Section 5: The Future of Continuous Blood Pressure Monitoring – What’s Next in 2026?

The race to dominate the continuous blood pressure (BP) monitoring space is well underway. With billions of dollars flowing into health tech and wearables, companies are scrambling to innovate, validate, and differentiate. This section maps the wrist and ring-based contenders, their technologies, and how their approaches compare.

In 2026, the real differentiators won’t be whether a wearable claims to estimate blood pressure — they will be:

· How transparent the technique and validation are

· Whether accuracy holds across populations and conditions

· How regulators classify the claim

· How these devices integrate into care pathways and reimbursement models

· How likely is the medical community to accept them

The field is moving fast, and 2026 may be the year we finally see real clinical lift‑off.

With so many algorithms for determining blood pressure, will it be safe for hospital systems’ EMRs to include these measurements in their records? Will research studies be able to compare blood pressure measurements from different devices? Without standardization, these measurements will most likely remain in their siloed ecosystems. The Validated Device Listing (VDL) for blood pressure devices will need to develop requirements for the next generation of devices.

Not only are the algorithms proprietary, but so are most Bluetooth protocols used by each device, keeping each ecosystem closed. Creating a standardized, open communication protocol for the various blood pressure measures and devices will enable broader adoption. For example, the only way to get data from the Apple Watch is through HealthKit. Similarly, to connect to the Hilo band, Hilo will have to make the communication protocol available. The wearable BP communication protocol differs from the HRM standard Bluetooth protocol that most vendors use to share heart rate data. We expect more companies to create API and SDKs to allow third-party software partners to integrate.

The availability of blood pressure data every hour, as the Hilo band provides, coupled with near-daily cuff-based measurements, will usher in a new era of blood pressure management, allowing providers to personalize treatments better and help patients reduce dependence on medications.

With an increasing number of wearable blood pressure devices coming to market and the need for supplementary cuff-based readings and calibrations, a solution is needed to allow devices and Apps such as Apple Health to seamlessly integrate cuff-based data without requiring pairing a Bluetooth device with a third-party app.

Cellular blood pressure devices are ecosystem-agnostic and can transmit cuff-based results directly to an ecosystem without the burden of using another Bluetooth device and App, and allow for continuous calibration.

New ‘hearable’ technologies using the ear are on the way. The Apple AirPods Pro 3 already detect heart rate. It won’t be long before devices like Google and Facebook’s smart glasses can detect both the wearers’ vitals and those of people in their field of view using ambient technologies that use radio waves and video analysis.

Ambient, passive, contactless technologies are also maturing. Look at companies such as Faceheart.com, Lifelight.ai, Cardio.io, and Cherryhome.ai in this space, where users do not require a device attached to their body.

The last two years have dramatically reshaped the landscape of continuous blood pressure (BP) monitoring. With the FDA clearing a few non-cuffs, wearable devices, and tech giants entering the space, the next wave is already in motion.

With Apple and Hilo’s approval, wearable rings are now mainstream. With increased support and more explicit guidance from the FDA and other federal agencies, 2026 is shaping up to be a tipping point. The future of cuffless BP monitoring will follow the course of new technology adoption cycles and will require infrastructure, regulation, and real clinical integration.

Expect More FDA-Cleared Devices — With Stricter Validation

I expect further loosening of controls, as RFK Jr is a strong proponent of wearable devices and remote monitoring, with a vision of making wearable technologies available to most people and central to improving healthcare. At the same time, the Federal government is working to remove barriers to AI adoption by hospitals, providers, and patients.

· The FDA is expected to release more tailored guidance for cuffless BP.

· Future 510(k) clearances, depending on claims and indications for use, may require stronger real-world validation (e.g., across multiple body positions and activity states).

· The emphasis will shift from small studies post-calibration to longitudinal performance over time.

Telehealth + Remote Patient Monitoring (RPM) Will Drive Adoption

· In 2026, Medicare and private insurers are increasingly reimbursing for RPM.

· Wearables that capture BP, HRV, sleep, and activity data will be ideal for longitudinal hypertension management.

· Integration with platforms like Epic, Teladoc, and HealthKit will be a key differentiator.

· Acute care management and hospital-at-home applications will benefit from continuous tracking for CHF, cancer, surgical, and other high-risk populations.

The Role of AI in Improving Accuracy and Insights

· Multi-sensor fusion (PPG, temperature, and motion) can be combined using machine learning to refine BP estimates.

· AI models will help personalize BP prediction based on individual biometrics, rather than one-size-fits-all calibrations.

· Predictive alerts for hypertensive crises, sleep-related BP dips, or white coat syndrome may emerge.

· Agents will have access to all the data, including medications, to personalize recommendations and augment primary care providers.

What the Industry Still Needs to Solve

The next phase will be won (or lost) on the unglamorous basics: shared validation standards, reimbursement, clinician literacy, and consumer understanding. Here are the four bottlenecks the industry must solve to turn promising tech into trusted care.

| Challenge | Why It Matters |

|---|---|

| Standard Validation Protocols | Devices use different benchmarks; need unified accuracy standards |

| Reimbursement Models | Clinicians need flexible ways to bill for BP data interpretation |

| Clinician Training | Many HCPs don’t understand how wearable BP devices work or when to trust them. They need to learn the new jargon. |

| Consumer Education | Users equate FDA clearance with clinical accuracy (it’s not the same) |

Over the next 12 months, expect sharper regulatory guidance, more real-world validation, and deeper AI-driven personalization. The big shift: wearable BP won’t just “track”—it will increasingly support decisions in RPM and everyday care.

As we move into 2026, rings and wearables may become the most comprehensive non-invasive diagnostic tools outside the hospital. But accuracy, validation, and integration into healthcare workflows remain key hurdles.

I’m personally looking forward to the first PTT device to come to market. I hope it will happen in 2026.

The Market Forecast: What’s Coming in 2026

The US Cuffless BP market is expected to increase at a 10.9% CAGR from 585.5M in 2022 to 1.3B in 2030. Some driving forces include:

· The Aging population + rising hypertension prevalence

· Remote patient monitoring (RPM) reimbursement expansion

· Demand for cuffless, passive, user-friendly solutions

· Increased agency for personal health and reduced availability and trust in doctors

What Should We Expect Next

· FDA guidance updates may call for new BP validation protocols specific to wearables, while also making it easier to evaluate new technologies.

· Multi-sensor fusion (PPG + temperature + motion + ECG) may improve estimation accuracy.

· Chronic condition integration: BP features may expand into RPM for diabetes, heart failure, and stroke prevention.

· Cloud-based BP calibration tools may reduce the need for cuffs in the future.

· More rings will emerge in BP estimation, especially in Asia and Europe.

· The first ring to measure blood pressure, similar to how the Hilo band works. i.e. CartBP

· More AI health coaches and clinical decision support solutions will hit the market, helping provide individual agency and reduce the burden of provider shortages and burnout.

The following 12 months will likely bring not just new devices, but a reshaping of the public’s understanding of what “measuring” BP really means and what responsibilities come with offering it.

Conclusion: The Consumer Will Decide

Wearable blood pressure monitoring is no longer science fiction. It is real, evolving fast, and increasingly placed in the hands of everyday people — not just clinicians. Over the past 24 months, the field has moved from concept to market. Apple has launched a BP notification feature built on unprecedented clinical scale. Hilo became the first continuous cuffless BP monitor cleared by the FDA. And rings like Oura, CART BP, and Circular are redefining the form factor of health tracking altogether.

We are tight-ropping from the innovators to the early adopters in the technology adoption lifecycle, and we still have a way to go before we reach the early majority, and with that, greater health for those who increasingly take more responsibility for their health.

In a world where the role of doctors is changing forever, and consumers are already tracking their sleep, glucose, and steps, blood pressure is the final frontier of personal health metrics. What was once a clinic-bound, episodic measurement is becoming continuous, ambient, and user-owned. As this technology matures, the market will reward not just innovation, but transparency, validation, and trust.

And in the end, it will be the consumer, not regulators or doctors, who decides what gets adopted. Direct-to-consumer healthcare sales are surging. Amazon and ChatGPT are increasingly platforms where consumers are finding care. People want tools that empower themselves. They want easy-to-use, ambient, passive, and wearable solutions that reduce friction and help them track their health and take action — whether it’s reducing salt intake, trying meditation, or knowing when to see a doctor. Longevity continues to inspire and motivate.

Still, limitations and friction remain. Few of today’s solutions have built-in cellular capability. Most rely on Bluetooth tethering to a smartphone, meaning true seamlessness and independence are still out of reach. There’s also the issue of calibration drift, validation gaps, and the regulatory gray zone between wellness and medical.

Yet despite these challenges, the direction is clear: BP monitoring is going where the consumer goes — onto the wrist, around the finger, and into the cloud. With that, patients will be able to receive more personalized and effective care.

The era of continuous blood pressure monitoring is here. And the companies that win will be the ones that listen, learn, and lead with the consumer in mind.

Thank you for joining me on the evolution of home-based blood pressure monitoring. We are looking forward to seeing you along the way.

If I missed, misled, or misinterpreted anything in this article, or you just want to ask a question, contact me at yair@cardiowell.com. Wishing you a long and healthy life, full of agency, empowerment, and happiness.

Reference List

Regulatory Clearances & Device Milestones

1. Apple Watch’s New Blood Pressure Alert Shakes Up the Smartwatch Health Race. Apple's Blood Pressure Notification Feature. https://ts2.tech/en/apple-watchs-new-blood-pressure-alert-shakes-up-the-smartwatch-health-race/

2. Apple Watch Hypertension Notification — FDA 510(k) Clearance

FDA 510(k) Summary for Apple’s Hypertension Notification Feature (HTNF).

https://www.accessdata.fda.gov/scripts/cdrh/cfdocs/cfpmn/pmn.cfm?ID=K250507 FDA Access Data

3. FDA Clearance Announcement for Apple Watch Hypertension Feature

Apple Watch receives FDA clearance for hypertension detection feature.

https://www.mobihealthnews.com/news/apple-receives-fda-nod-hypertension-notification-feature MobiHealthNews

4. Apple Watch Hypertension Notifications Overview

Apple’s newsroom announcement about hypertension notifications on Apple Watch.

https://www.apple.com/newsroom/2025/09/apple-debuts-apple-watch-series-11-featuring-groundbreaking-health-insights/ Apple

5. Hilo (Aktiia) Band — First Cuffless BP Monitor Cleared by FDA

Aktiia’s Hilo Band receives FDA 510(k) clearance for over-the-counter cuffless BP monitoring.

https://www.prnewswire.com/news-releases/aktiias-hilo-band-becomes-first-cuffless-blood-pressure-monitor-cleared-by-fda-for-over-the-counter-use-302501123.html PR Newswire

6. MedTech Dive Coverage of Hilo FDA Clearance

Coverage of Aktiia’s Hilo Band FDA clearance as the first over-the-counter cuffless BP monitor.

https://www.medtechdive.com/news/aktiia-josep-sola-otc-blood-pressure/758162/ MedTech Dive

7. Additional Media Coverage of Hilo FDA Clearance

Further reporting on the Hilo Band clearance and anticipated 2026 US launch.

https://www.mobihealthnews.com/news/aktiia-gets-fda-clearance-otc-cuffless-blood-pressure-monitor MobiHealthNews

Clinical & Technology Context

7. Apple Watch Hypertension Notifications Algorithm & Validation

Apple’s official validation document for the Hypertension Notification Feature.

https://www.apple.com/health/pdf/Hypertension_Notifications_Validation_Paper_September_2025.pdf Apple

8. Analysis of Apple Watch BP Feature in HealthBeat Reporting

Discussion of Apple Watch sensitivity and specificity for hypertension detection.

https://www.healthbeat.org/2025/10/15/apple-watch-blood-pressure-alert-hypertension/ Healthbeat

FDA + Regulatory Insights

9. FDA Clearance Criteria Clarification

Explanation of the 510(k) pathway and what “substantial equivalence” means.

https://www.fda.gov/medical-devices/premarket-notification-510k FDA Access Data

10. FDA Public Warning about Unreviewed BP Tech

FDA warns against use of unreviewed blood pressure technologies.

https://www.fiercebiotech.com/medtech/following-apple-watchs-hypertension-clearance-fda-warns-public-against-using-unauthorized Fierce Biotech

Market & Broader Context

11. Global Hypertension Prevalence (WHO Report)

World Health Organization Global Hypertension Report (2024).

https://www.who.int/publications/i/item/9789240129285 (Note: link to WHO report can be added manually if citing specific text)